What will happen, If Pakistan Defaults?

Pakistan’s pursuit of the ninth review of its International Monetary Fund (IMF) program has proven to be elusive, casting doubt on the program’s completion as it nears its end (Jun’23).

According to an extensive report by Arif Habib Limited (AHL), Pakistan faces $5 billion in external debt servicing requirements and a sovereign default is likely, given how support from friendly countries is often tied to the IMF’s tacit approval.

The country’s foreign exchange reserves are at a dangerously low level (USD 4.3 billion), and Pakistan is confronted with significant debt repayments until June 2024.

Even in the most optimistic scenario where Pakistan might be able to receive support from bilateral friends (Saudi Arabia, UAE, and China) in the form of both rollovers and fresh funding and also run a balanced current account, the country still faces a shortfall of $5 billion to meet the external debt servicing requirement of $27 billion in FY24, said the report.

This clearly highlights the magnitude of challenges and risks ahead. Given support from friendly countries is often tied to IMF’s tacit approval, a lack of breakthrough with the fund would make sovereign default a very high probability.

While the report’s base case assumption is that Pakistan will avert default by remaining engaged with the IMF along with support from major bilateral creditors, sovereign default nonetheless remains a real possibility.

In the case of Pakistan, if it were to default on its debt, it would likely face difficulty in borrowing further funds, as lenders become reluctant to lend due to the high risks involved.

Moreover, even if Pakistan is able to secure a loan, the interest rates attached to it are likely to be very high only adding a burden to the mark-up servicing of the country.

A similar situation was witnessed back during 1998-99 when Pakistan was on the brink of default and resorted to a variety of measures to raise funds from external sources as well as restructure some debt.

If Pakistan defaults on its debt, it may become more difficult for the country to import even essential goods such as petroleum, machinery, and medicinal products.

Approximately 73.4 percent of total imports account for essentials, as of 10MFY23. Moreover, in case of default, exports may suffer from a combination of nonavailability of raw materials, energy shortages as well cancellation/shift of export orders to more stable competitors.

As of 10MFY23, 60.8 percent of Pakistani exports are from textiles which itself is reliant on the import of raw materials such as cotton.

More importantly, Pakistan is already facing severe inflationary pressure, with headline inflation hovering above 28 percent FYTD which could amplify manifold in case of a default event.

Pakistan could see a sharp contraction in GDP as well as devaluation of the currency. Already struggling with economic challenges like high commodity prices, political instability, and a weak currency, Pakistan’s GDP is expected to slow down in FY23 to ~1 percent. However, a default shall only make matters worse with GDP likely to contract.

Default Exposure on Local Banks

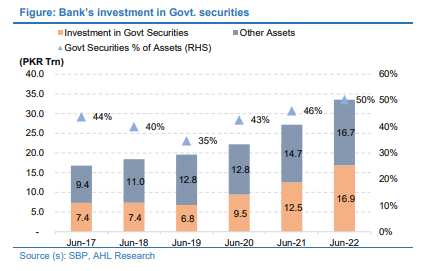

Given that Pakistani banks have very high exposure to government debt in the form of both investments in government treasuries (50 percent of assets) and lending to government-owned entities (6 percent), sovereign default can result in a major spillover onto the domestic banking sector.

Default could also result in economic sanctions being imposed on Pakistan by its creditors. International creditors could file lawsuits to recover the unpaid debts or to force Pakistan to fulfill its obligations. Even worse, a default could lead to a further downgrade of Pakistan’s already low credit rating which would make it extremely expensive for the country to borrow money in the future.

Pertinently, Pakistan’s credit rating is currently Caa3 (Moody’s) / CCC+ (S&P), which is considered to be a speculative or “junk” grade.

Way Forward: Debt Restructuring Post-Default

In the event of a default, Pakistan would need to undergo an extensive debt restructuring exercise given the scale of debt servicing requirements over the next 2-3 years. The total public external debt outstanding as of Mar’23 is USD 96 billion (28 percent of GDP) out of which USD 37 billion relates to multilateral creditors likely to be excluded from any debt restructuring exercise.

Taking a clue from Sri Lanka, Pakistan would have to engage in separate negotiations with China, other bilateral creditors, and Paris Club to chalk out a restructuring plan which also needs to have the umbrella of the IMF.

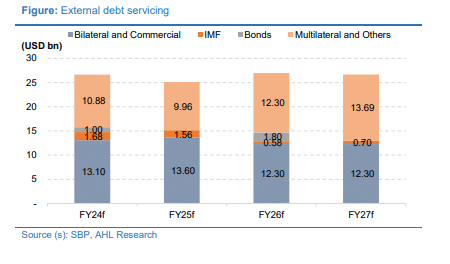

To put things in perspective which was also highlighted in AHL’s earlier report “Debt reprofiling or restructuring?” Pakistan has a total external debt servicing requirement of $73 billion over FY24-27 out of which USD 39 billion are short-term bilateral borrowings mainly from friendly countries (Saudi Arabia, China, and UAE) and their commercial banks.

In essence, the total quantum of borrowing from friendly countries is USD 13 billion which is projected to be rolled over annually.

And then there’s the IMF. The report says a defaulter Pakistan would have to undertake a new long-term IMF program to achieve macroeconomic stability via strong policy measures and deep structural reforms ahead of any discussions on debt restructuring.

All things considered, China still remains the single most important bilateral partner for Pakistan given the deep strategic and economic links. It is also the single largest bilateral creditor contributing to an estimated 30 percent of Pakistan’s total external debt of USD 96 billion and shall play a very important role in any post-default scenario.

While China is likely to play a constructive role in helping Pakistan avoid a default event, its role in a post-default scenario will be even more critical, particularly on two key counts.

Firstly, any post-default restructuring will be impossible without China, and support from major creditors in particular China is likely to be a key precondition for any new post-default IMF program similar to what was witnessed in the case of Sri Lanka. China is likely to give similar assurances in a possible post-default scenario.